Financial Highlights of 2023:

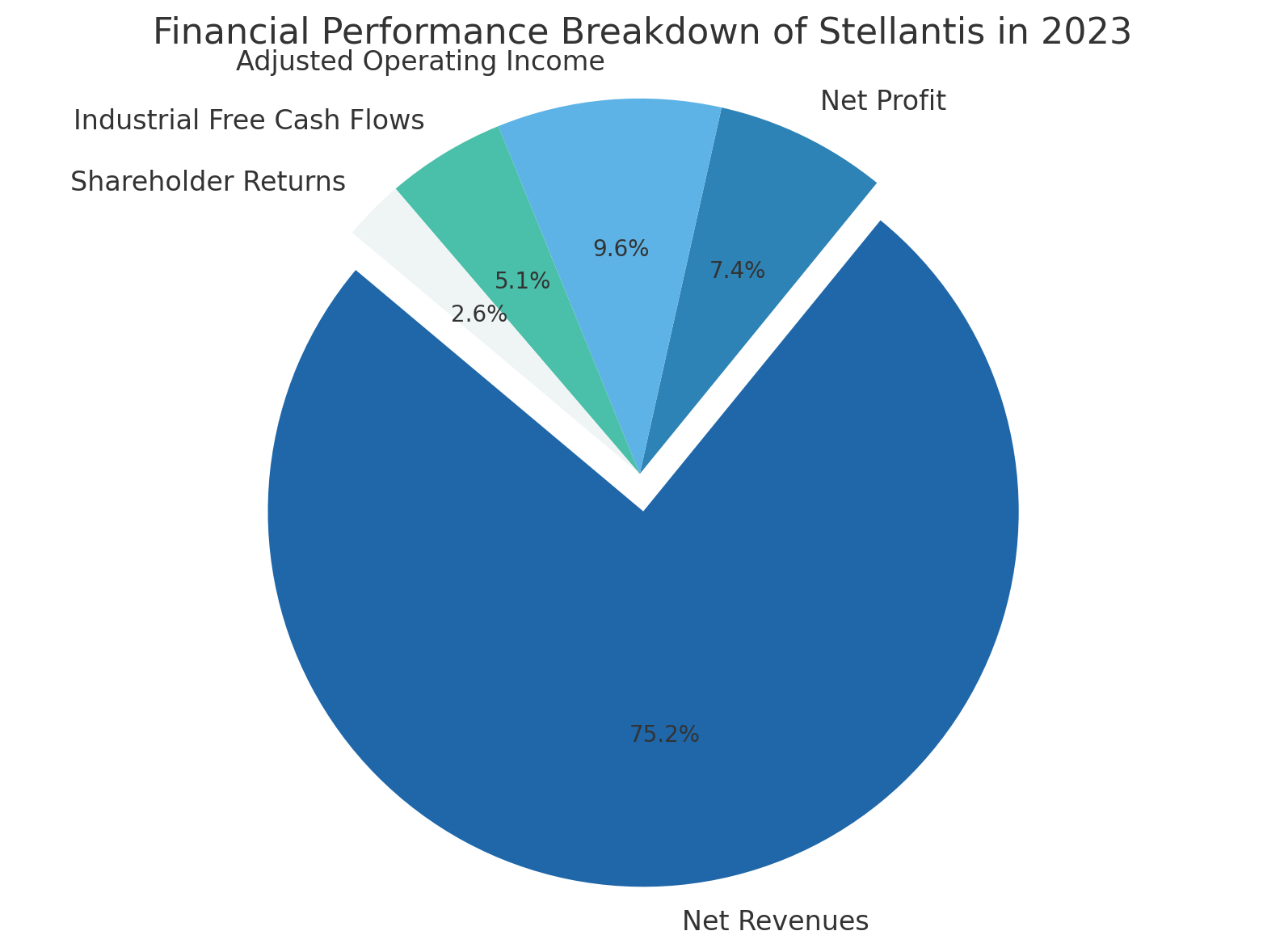

- Net Revenues: Stellantis saw its net revenues climb to €189.5 billion, a 6% increase from the previous year, driven by a 7% rise in consolidated shipment volumes.

- Net Profit: The net profit surged by 11% to reach €18.6 billion, reflecting the company's efficient cost management and strong market positioning.

- Adjusted Operating Income (AOI): The AOI rose modestly by 1% to €24.3 billion, with an AOI margin of 12.8%, underscoring the company's profitability in a competitive landscape.

- Industrial Free Cash Flows: Demonstrating financial resilience, Stellantis reported a 19% increase in industrial free cash flows to €12.9 billion.

- Shareholder Returns: In a significant move to reward its shareholders, Stellantis returned €6.6 billion in cash through dividends and share buybacks, marking a 53% increase from 2022.

Operational Excellence & Strategic Milestones:

- Electrification Leadership: Stellantis made remarkable progress in electrification, with LEV sales up by 27% in 2023. The company solidified its position with PHEVs ranking #1 in the U.S. and #2 for LEVs, alongside a 21% increase in global BEV sales.

- Sustainability Commitments: The company remains on track to achieve its carbon net-zero emission target by 2038, reducing its scope 1 and 2 absolute emissions by 20% compared to the baseline year of 2021.

- Innovation and Growth: Stellantis is set to launch 18 additional BEVs in 2024, expanding its total to 48 models by year-end, highlighting its commitment to electrification and innovation.

- Global Expansion: The investment in Leapmotor, a leading NEV OEM in China, signifies Stellantis's strategic move to capture growth in the Chinese market and beyond, demonstrating its global expansion strategy.

2024 Outlook:

Stellantis is optimistic about 2024, expecting a supportive revenue backdrop thanks to reduced supply and logistical constraints, stabilizing interest rates, and an expanded product offering. Despite macroeconomic uncertainties, the company reaffirms its commitment to achieving a double-digit AOI margin and positive industrial free cash flows.

Conclusion:

Stellantis's record-breaking performance in 2023 clearly indicates its resilience, strategic foresight, and operational efficiency. With a strong focus on electrification, sustainability, and global expansion, Stellantis is well-positioned to navigate future challenges and continue delivering value to its stakeholders.

The information on mexem.com is for general informational purposes only. It should not be regarded as investment advice. Investing in stocks involves risk. A stock's past performance is not a reliable indicator of its future performance. Always consult a financial advisor or trusted sources before making any investment decisions.

.png)

.jpg)

.jpg)